Receiving an injury settlement comes with significant financial implications, including taxable income for the IRS. Consulting a legal professional is crucial to understand deductions and exemptions under state laws, ensuring compliance with tax obligations, and avoiding potential legal consequences. Strategic planning, proper documentation, and exploring alternative settlement structures can reduce tax liabilities. Engaging qualified accident attorneys specializing in personal injury cases and tax law is essential to manage taxes effectively and receive full compensation after an injury.

Navigating the world of injury settlements can be complex, especially when it comes to understanding the associated tax implications. This article guides you through the process of avoiding potential tax issues with injury settlements. We delve into crucial strategies and common pitfalls to ensure you’re aware of the financial obligations from the get-go. By understanding the tax implications and employing effective minimization tactics, you can secure your financial future post-settlement.

- Understanding Injury Settlement Tax Implications

- Strategies to Minimize Tax Obligations from Settlements

- Common Pitfalls and How to Avoid Them in Injury Settlement Taxes

Understanding Injury Settlement Tax Implications

When receiving an injury settlement, it’s crucial to understand the tax implications that come with it. Unlike other forms of income, settlement amounts are often considered a single, lump-sum payment for damages, which can have distinct tax consequences. This is where an accident attorney can provide guidance, ensuring their clients fully comprehend the potential tax burden on their recovery.

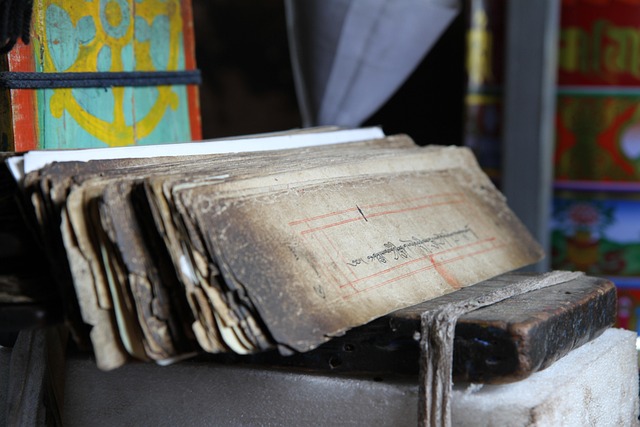

The IRS treats injury settlements as taxable income, meaning you’ll need to declare the full amount on your tax return. However, certain deductions and exemptions might apply, depending on state laws and the nature of the injury. For instance, if a client’s injuries resulted in medical expenses exceeding a certain threshold, these costs may be deductable from their settlement. Moreover, understanding the fiduciary duty breaches that can occur with settlements is essential; mismanaging or mishandling funds allocated for taxes could lead to legal issues down the line.

Strategies to Minimize Tax Obligations from Settlements

When receiving an injury settlement, it’s crucial to implement strategic measures to minimize tax obligations. One effective approach is to ensure proper documentation and record-keeping. This includes meticulously documenting all expenses related to the injury, such as medical bills, rehabilitation costs, and any other associated expenses. By maintaining detailed records, individuals can accurately deduct these eligible expenses from their taxable income, thereby reducing the overall tax burden.

Additionally, exploring alternative settlement structures can be beneficial. For instance, negotiating a structured settlement agreement allows for periodic payments over time rather than a lump-sum payout. This strategy can distribute taxable income across multiple years, potentially lowering the annual tax liability. It’s advisable to consult with legal and financial professionals who can guide individuals through these options, especially when dealing with complex cases like employment disputes or caregiver abuse, where breach of fiduciary duty may be involved.

Common Pitfalls and How to Avoid Them in Injury Settlement Taxes

Many individuals face common pitfalls when it comes to understanding and managing tax implications of injury settlements. A significant portion of the settlement amount often ends up being absorbed by taxes, leaving the victim with less compensation than expected. One of the primary reasons for this is the lack of awareness about the taxability of such awards. Not all damages are taxable; medical expenses, lost wages, and pain and suffering are generally exempt from taxation as they represent actual out-of-pocket costs or future earnings projections. However, any monetary award for non-economic damages, like loss of quality of life, is subject to taxes.

To avoid these issues, individuals should consult with a qualified accident attorney who specializes in personal injury cases and has expertise in tax law. They can help navigate the complex landscape of tax laws surrounding injury settlements. Another crucial step is to ensure proper documentation and record-keeping. This includes maintaining detailed records of all medical expenses, income loss, and other relevant financial information related to the accident. Additionally, being mindful of how the settlement is structured can make a difference. For instance, splitting the award into separate categories for different types of damages can help in managing tax liabilities more effectively. Lastly, understanding the concept of imputation income—where future earnings capacity is estimated and taxed based on present-day values—is essential to minimize tax burdens on long-term settlements.

When navigating an injury settlement, understanding the associated tax implications is crucial. By implementing effective strategies to minimize tax obligations, individuals can ensure they receive the full benefit of their settlements. Avoiding common pitfalls, such as failing to consider tax liabilities promptly or misinterpreting tax-exempt status, will help protect your financial interests in the long run. Remember that seeking professional advice is key to managing injury settlement taxes and ensuring compliance with legal requirements.